SP500 LDN TRADING UPDATE 3/2/26

SP500 LDN TRADING UPDATE 3/2/26

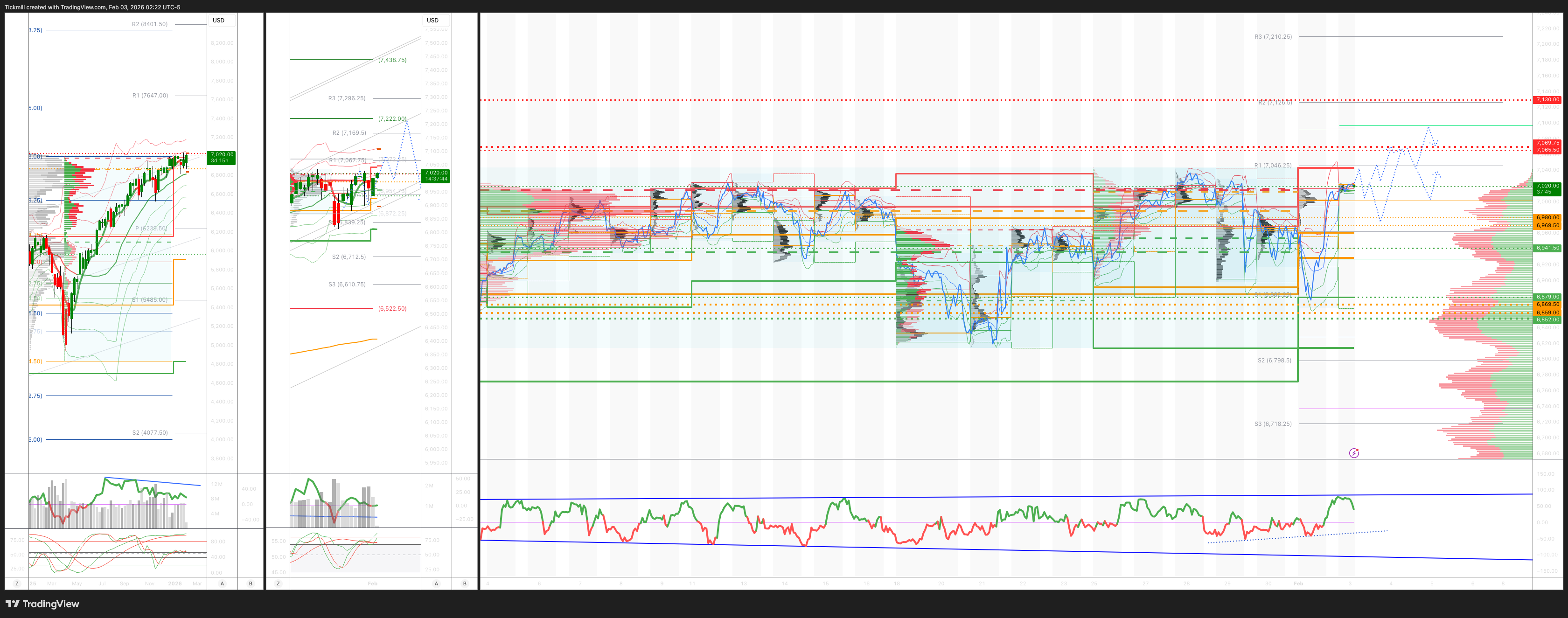

WEEKLY & DAILY LEVELS

***QUOTING ES1! FOR CASH US500 EQUIVALENT LEVELS, SUBTRACT POINT DIFFERENCE***

WEEKLY BULL BEAR ZONE 6859/69

WEEKLY RANGE RES 7058 SUP 6869

FEB OPEX STRADDLE 6726/7154

MAR QOPEX STRADDLE 6466/7203

DEC 2026 OPEX STRADDLE 5889/7779

GAMMA FLIP LEVEL 6962

DAILY VWAP BULLISH 6988

WEEKLY VWAP BULLISH 6974

MONTHLY VWAP BULLISH 6896

DAILY STRUCTURE – BALANCE - 7031/6898

WEEKLY STRUCTURE – BALANCE - 7031/6822

MONTHLY STRUCTURE – ONE TIME FRAMING HIGHER - 6822

DAILY BULL BEAR ZONE 6980/70

DAILY RANGE RES 7065 SUP 6941

2 SIGMA RES 7130 SUP 6879

VIX BULL BEAR ZONE 20

PUT/CALL RATIO 1.26 (The numbers reflect options traded during the current session. A put-call ratio below 0.7 is generally considered bullish, and a put-call ratio above 1.0 is generally considered bearish)

TRADES & TARGETS

LONG ON REJECT/RECLAIM DAILY BULL BEAR ZONE TARGET 7043 > WEEKLY/DAILY RANGE RES

SHORT ON REJECT/RECLAIM WEEKLYDAILY RANGE RES TARGET 7043>7005

(I FADE TESTS OF 2 SIGMA LEVELS ESPECIALLY INTO THE FINAL HOUR OF THE NY CASH SESSION AS 90% OF THE TIME WHEN TESTED THE MARKET WILL CLOSE ABOVE OR BELOW THESE LEVELS)

GOLDMAN SACHS TRADING DESK VIEW - “Groundhog Day”

US stocks are kicking off the week on a strong note, with Industrials, Financials, and Staples driving the S&P 500 higher. This comes as markets digest one of the strongest ISM Manufacturing survey readings in years, while gearing up for a big week of earnings reports and the upcoming Payrolls data release on Friday.

Winter Lingers, and Earnings Season Marches On

Punxsutawney Phil saw his shadow this morning, predicting six more weeks of winter. Thankfully, the groundhog's accuracy is only around 40%—here’s hoping for an early spring. While the length of winter remains uncertain, earnings season is in full swing. So far, 33% of S&P 500 companies, representing 47% of the index’s market cap, have reported Q4 2025 results. This week, another 130 companies, accounting for 24% of market cap, are set to report (as detailed in Ben Snider’s US Weekly Kickstart, “Mid-season S&P 500 earnings update”).

Currently, 59% of companies have beaten consensus EPS expectations by more than one standard deviation, a slight decline from 66% last quarter but still above the historical average of 49%. S&P 500 EPS growth is tracking at +11% year-over-year, surpassing the initial consensus forecast of +7% growth at the start of the season. Looking ahead, the outlook for S&P 500 EPS growth in 2026 remains robust. Of the 50 companies providing 2026 EPS guidance, 54% have exceeded consensus expectations, compared to the historical average of 40%.

Mega-Cap Tech in the Spotlight

This week, mega-cap tech will be closely watched, especially following last week’s mixed reactions to MSFT, META, and AAPL earnings. While all three companies beat consensus estimates for sales and EPS, their stock performances diverged: MSFT dropped ~10%, META surged ~10%, and AAPL remained flat.

- GOOGL: Analyst Eric Sheridan highlights GOOGL’s strong positioning across multiple AI-driven themes, including query volumes, monetization, shifting media habits, cloud computing, foundational model scaling, and physical AI. Industry checks indicate GOOGL is likely to sustain these trends into 1H26, but its recent stock outperformance could make it more susceptible to changes in market sentiment.

- AMZN: Sheridan identifies AMZN as one of his top large-cap picks for the year. Key focus areas include the company’s efforts to reaccelerate AWS year-over-year growth rates, investments in AWS capex and custom silicon, growth in advertising initiatives, and continued gains in eCommerce market share.

- UBER: This week, UBER updates are expected regarding its advancements in autonomous vehicle (AV) technology and developments in food delivery services.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!