Institutional Insights: Credit Agricole FX Weekly 31/10/25

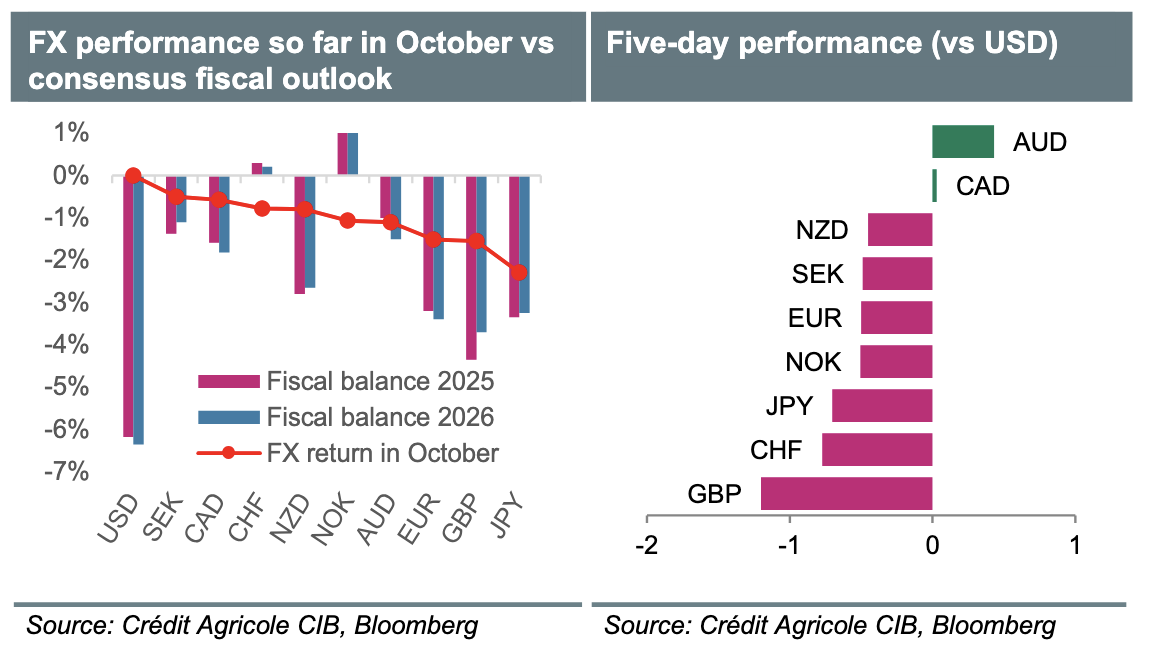

The month of October witnessed a notable shift in the currency market dynamics, particularly concerning the USD. Following a period of downtrend, the USD started to reverse its fortunes as the euro (EUR) rally began to lose momentum. At the same time, the selling pressure on the British pound (GBP) and the Japanese yen (JPY) intensified.

A key factor influencing these developments has been a renewed market focus on fiscal policies in light of significant government changes occurring in France and Japan, as well as the anticipation of the UK’s November budget. Foreign exchange (FX) investors tend to shy away from currencies exhibiting wide fiscal deficits. This is due to the perception that high fiscal deficits can lead to a multitude of negative outcomes, including eroding political stability, increasing government borrowing costs, necessitating austerity measures that can stifle growth, and raising concerns of fiscal dominance over central banks.

Despite ongoing concerns about the deteriorating fiscal outlook in the United States, exacerbated by the government shutdown, the USD has managed to gain traction. One possible explanation for this resilience may be rooted in the concept of US exceptionalism, which suggests that the U.S. Treasury (UST) market is relatively insulated from pressures typically exerted by bond market vigilantes. Additionally, the recent adjustments in the market's expectations regarding the Federal Reserve’s (Fed) dovish stance could indicate a reduction in fears related to fiscal dominance. As the upcoming week approaches, market attention is expected to pivot towards US economic data and comments from Fed officials.

Meanwhile, the GBP appears to be at risk ahead of the Bank of England's (BoE) policy meeting in November. FX investors are concerned that any new austerity measures linked to the upcoming budget could potentially harm the economy and suppress inflation. This scenario would likely lead the BoE to adopt an even more dovish approach. Although there is skepticism about whether the BoE will align with market expectations, the general caution among FX investors regarding the budget may limit any significant upward movement for the GBP.

In Australia, the recent acceleration in underlying inflation, now sitting at the upper threshold of the Reserve Bank of Australia’s (RBA) target band of 2-3%, effectively rules out the possibility of a rate cut in the upcoming week. Anticipating a more stringent stance, the RBA is expected to elevate its forecasts for inflation and the unemployment rate. Given that the market continues to speculate on a potential rate cut by mid-2026, this environment is likely to lend support to the Australian dollar (AUD).

Looking at the Nordic region, both the Norges Bank and the Riksbank, having cut rates in September, are forecasted to maintain their current policy settings during November. Notably, the Riksbank has indicated that it has concluded its easing cycle, whereas the Norges Bank does not foresee any further cuts before well into 2026, suggesting that may be the only adjustment for that year.

Lastly, the Canadian dollar (CAD) is expected to be closely monitored in light of the balancing act required in the upcoming Fall Budget. There will be careful consideration to ensure that any additional fiscal stimulus does not compromise the fiscal soundness of Canada.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!