Vaccine Breakthrough and Biden’s win Appears to be Priced in. But What’s Next?

Trump slowly but surely gains support in the fight against what he considers blatant electoral fraud. Contrary to perception that fellow Republicans will gradually shun from the rebel and think about how to get along with the new administration, the GOP’s leader in the Senate Mitch McConnell throwed support behind Trump said that he is within his rights to demand a recount as well as legally pursue voting irregularities if he believes they occurred.

US Attorney General William Barr, a well-known Trump ally, authorized prosecutors to investigate possible cases of fraud in the ballot counting process. For the first time, the Minister of Justice is authorizing an investigation in the immediate aftermath of the elections. The wording of the Barr’s memo issued to US prosecutors appears to carry a slight bias: to authorize the investigation of "clear and apparently-credible allegations of irregularities that, if true, could potentially impact the outcome of a federal election in an individual state"

US political developments rattled US futures overnight which retreated after hitting all-time high on Tuesday. But the market consensus on who will become the next president is still intact. Equity markets were buoyed up yesterday by news of successful Phase III vaccine trial by Pfizer, but keep in mind that the 90% effectiveness claim is preliminary. At the end of November, Pfizer expects to receive more information on efficiency, safety and manufacturing processes. Only then can the company apply for authorization of emergency use of the vaccine in the United States.

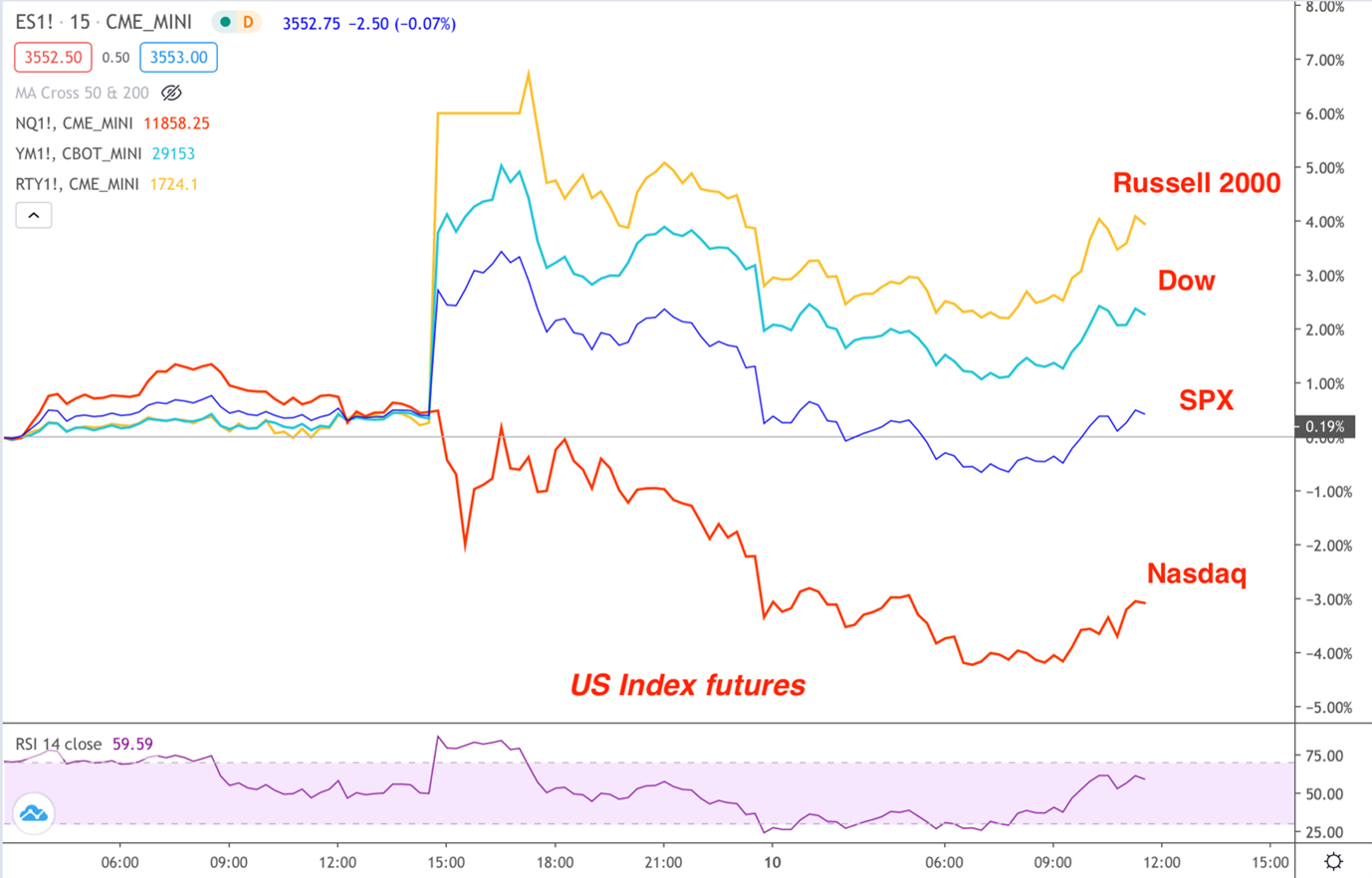

Considering the rally of the major US stock indices, small-cap Russell 2000 index rose stronger than others, followed by DOW and SPX. In contract, Nasdaq futures tanked:

This behavior tells us that investors placed a bet on lifting of social restrictions and recovery of mobility and lagging Nasdaq could reflect corresponding rotation from the tech sector to undervalued ‘value’ stocks.

Treasury yields rose to March values, the yield on 10-year bond approached 1%. Accordingly, expectations began to form in the federal funds rate futures market (still weak) that the Central Bank will begin to tighten monetary policy earlier than in 2023. As you know, this is the second threat to the market after a prolonged pandemic.

In the financial stability report released on Monday, the US Central Bank stressed that the big risk is the delayed production and distribution of the vaccine. That is, development is one thing, but there are stages that come next and they are important as well. For equity markets to extend rally we have to have some meaningful upside catalyst, but Biden's victory and the news on a successful vaccine trial have been already priced in. Without a next catalyst, the prospect of a new leg of the rally should be treated with caution.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.