Daily Market Outlook, June 18, 2024

Munnelly’s Macro Minute…

“French Political Turmoil Front And Center ”

On Tuesday, the Reserve Bank of Australia (RBA) decided to keep rates unchanged, citing persistent domestic price pressures. This is a common issue faced by central banks worldwide. The day was relatively quiet in Asia, with limited economic data in Europe. Attention now shifts back to political unrest in the region. However, futures indicate that markets may recover after last week's downturn.

Campaigning for France's snap parliamentary election began on Monday, with polls predicting a victory for the far-right National Rally over a left-wing alliance. President Emmanuel Macron's centrist group is currently trailing in third place. In the United States, all eyes are on May's retail sales figures and speeches from six Fed officials.

Stateside It is expected that retail sales in May will show a slight increase compared to April's disappointing results. However, overall consumer spending momentum is anticipated to slow down. Regarding the Fed's communication, policymakers are likely to echo Chair Jerome Powell's sentiments from last week, especially after the recent benign inflation report.

While many countries are considering loosening monetary policy, Japan's central bank governor Kazuo Ueda mentioned the possibility of raising interest rates next month depending on economic data. This underscores the commitment to gradually reduce extensive stimulus measures. Despite this news, the Japanese yen barely reacted and remained weak against the dollar on Tuesday. It seems that investors have tempered their expectations regarding the Bank of Japan, particularly after last week's policy decision, which did not meet the expectations of those anticipating an immediate reduction in bond purchases.

Overnight Newswire Updates of Note

Australia Holds Key Rate At 12-Year High On Inflation Worries

BoJ’s Ueda Keeps July Rate Hike Door Open Amid Skepticism

Mester Urges Fed To Explain Its Decisions, Policies More Clearly

Fed’s Harker: One Rate Cut In 2024 Is Appropriate Based On Outlook

EU Leaders Delay Top-Jobs Deal, Adding To Post-Election Turmoil

AUD/USD Defends 0.6600 After RBA's Status Quo, Bullock's Presser Eyed

Oil Holds Gain As Risk-On Sentiment Helps To Support Commodities

Citi Ramps Up US Stock Outlook, Joining Goldman And Evercore ISI

(Sourced from Bloomberg, Reuters and other reliable financial news outlets)

FX Options Expiries For 10am New York Cut

(1BLN+ represent larger expiries, more magnetic when trading within daily ATR)

EUR/USD: 1.0670-75 (2.8BLN), 1.0700 (1.4BLN), 1.0725-30 (1.6BLN)

1.0750-60 (1.3BLN), 1.0775 (1BLN)

USD/CHF: 0.8850 (309M), 0.8915 (300M), 0.9000 (255M)

GBP/USD: 1.2675 (308M)

AUD/USD: 0.6585-0.6600 (1.3BLN), 0.6615 (319M), 0.6650 (453M), 0.6700 (837M)

NZD/USD: 0.6100 (377M)

USD/CAD: 1.3670-80 (550M), 1.3745-55 (793M), 1.3800 (519M)

USD/JPY: 156.50 (351M), 158.00 (488M)

CFTC Data As Of 14/06/24

Equity fund speculators increase S&P 500 CME net short position by 20,612 contracts to 352,937

Equity fund managers raise S&P 500 CME net long position by 13,149 contracts to 967,970

Euro net long position is 43,644 contracts

Japanese yen net short position is 138,579 contracts

British pound net long position is 52,121 contracts

Swiss franc posts net short position of -42,863

Bitcoin net short position is -1,138 contracts

Technical & Trade Views

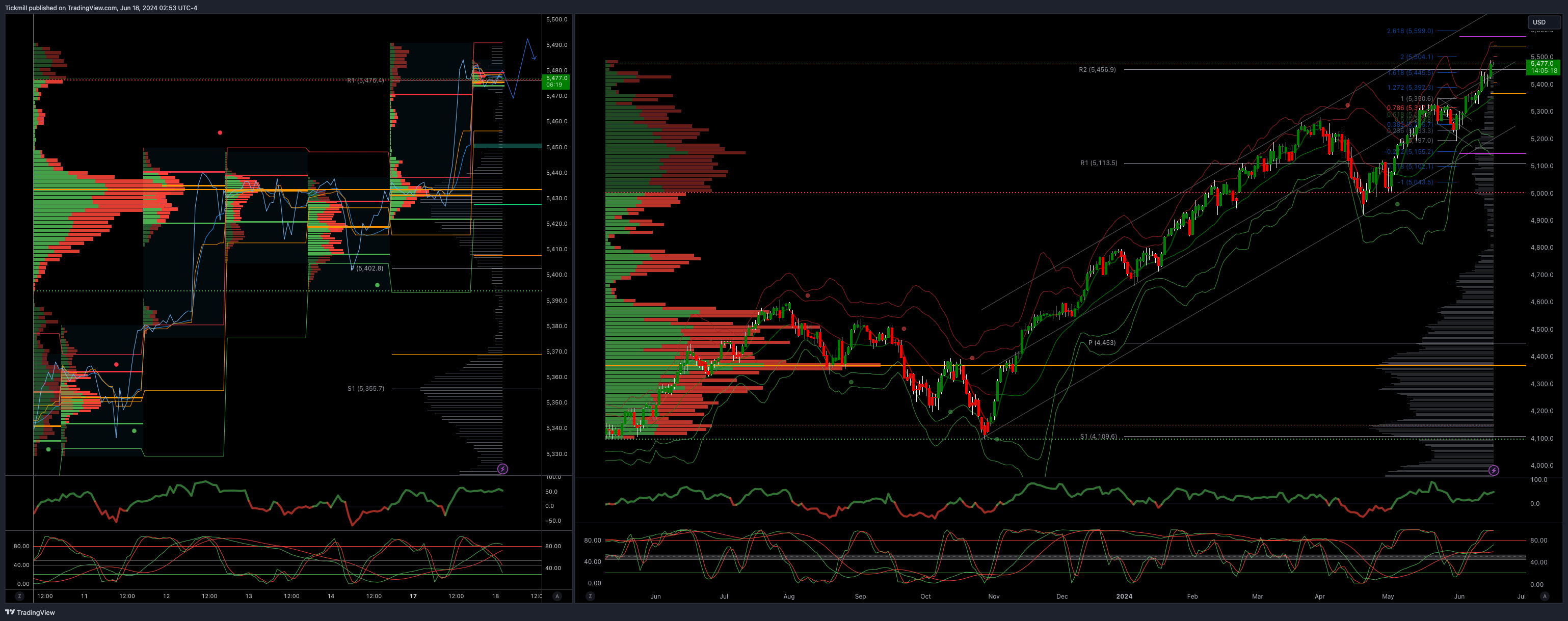

SP500 Bullish Above Bearish Below 5465

Daily VWAP bullish

Weekly VWAP bullish 5354

Below 5400 opens 5385

Primary support 5370

Primary objective is 5465 TARGET HIT NEW PATTERN EMERGING

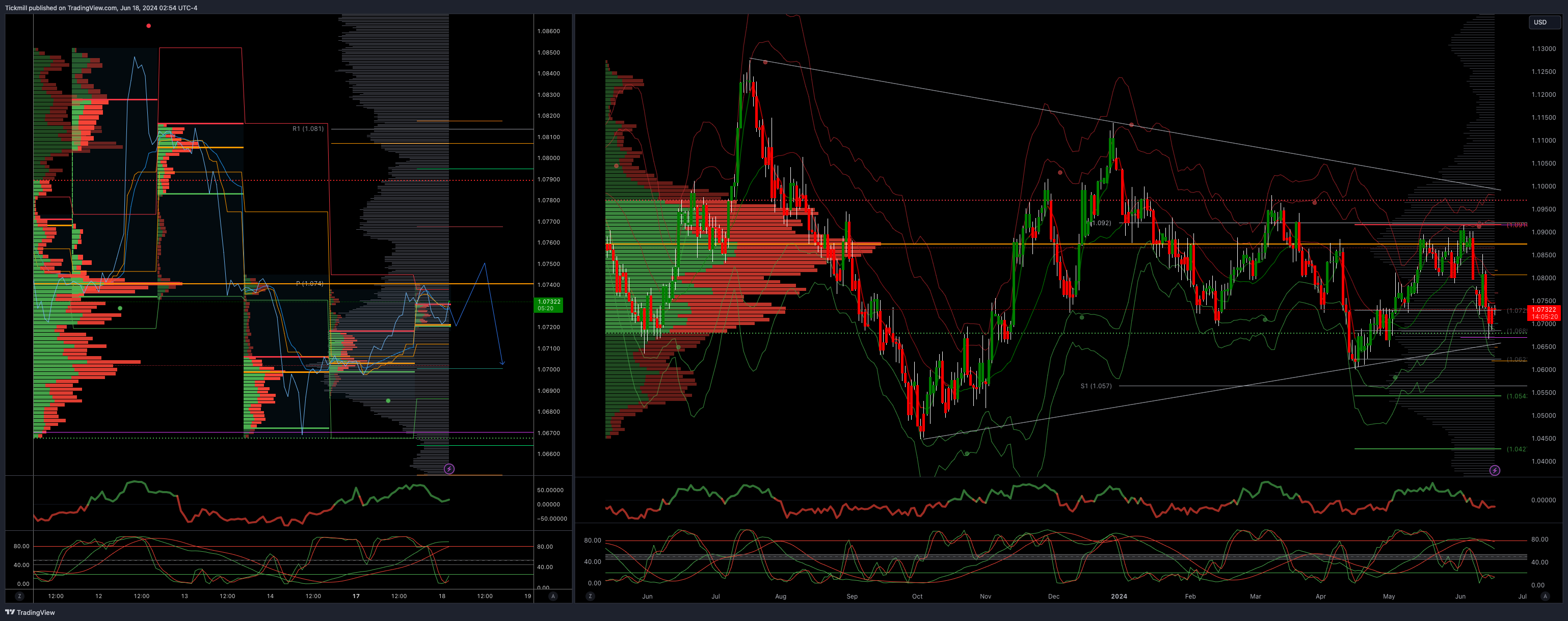

EURUSD Bullish Above Bearish Below 1.0780

Daily VWAP bearish

Weekly VWAP bearish 1.0788

Above 1.880 opens 1.0940

Primary resistance 1.0981

Primary objective is 1.0650

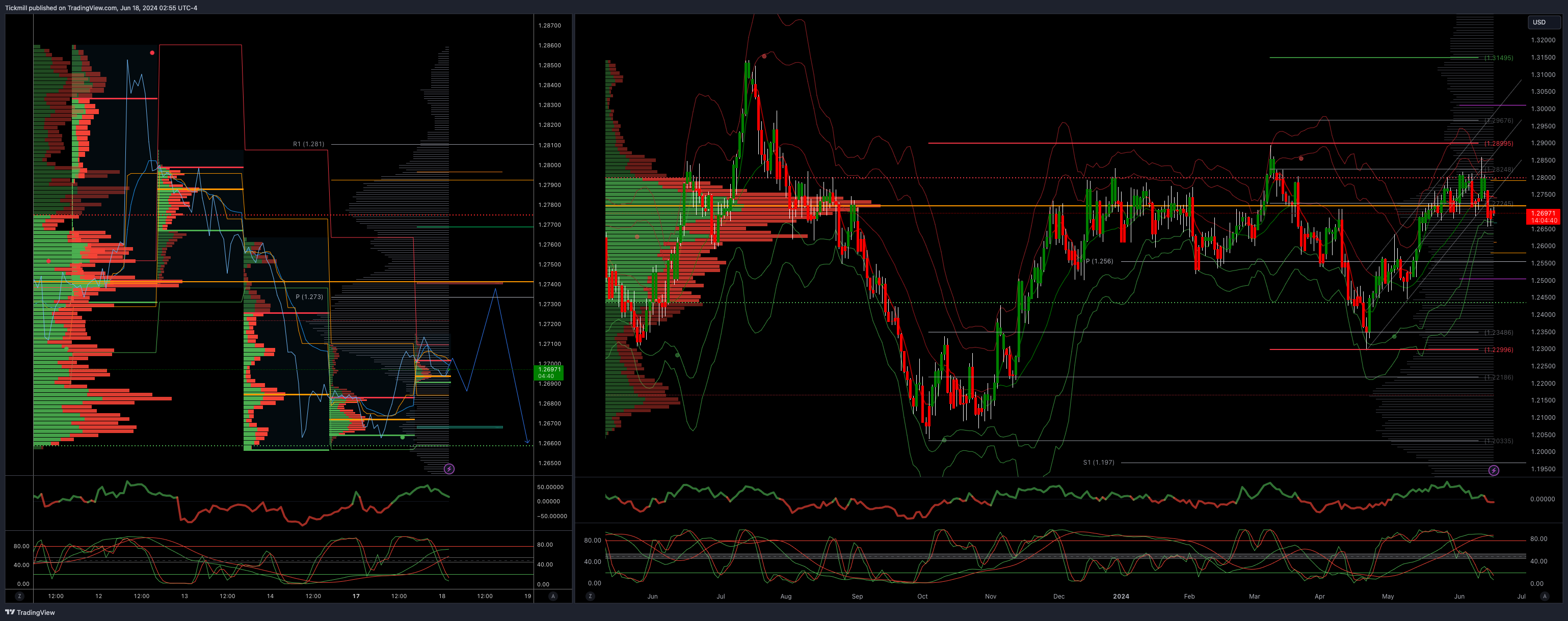

GBPUSD Bullish Above Bearish Below 1.2760

Daily VWAP bullish

Weekly VWAP bearish 1.2715

Below 1.2740 opens 1.2690

Primary resistance is 1.2890

Primary objective 1.2640

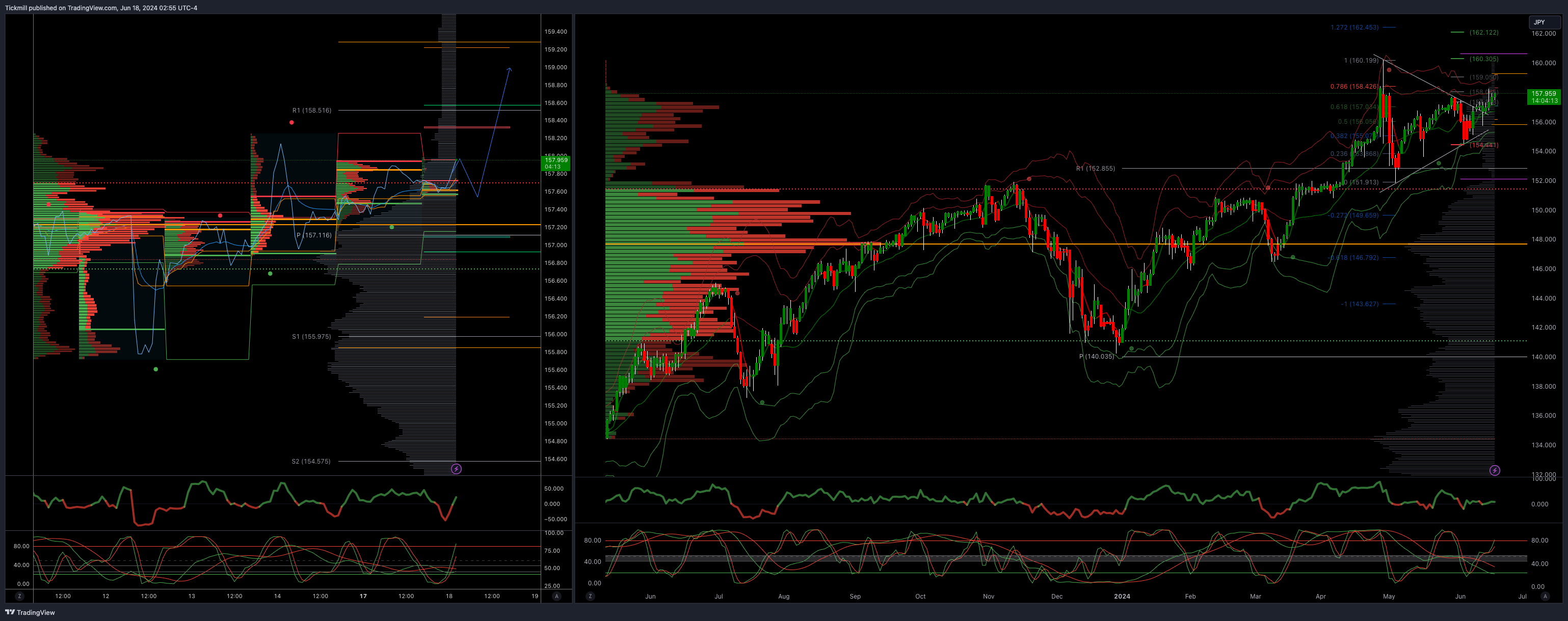

USDJPY Bullish Above Bearish Below 157.20

Daily VWAP bullish

Weekly VWAP bullish 156.60

Below 156.80 opens 155.80

Primary support 152

Primary objective is 160

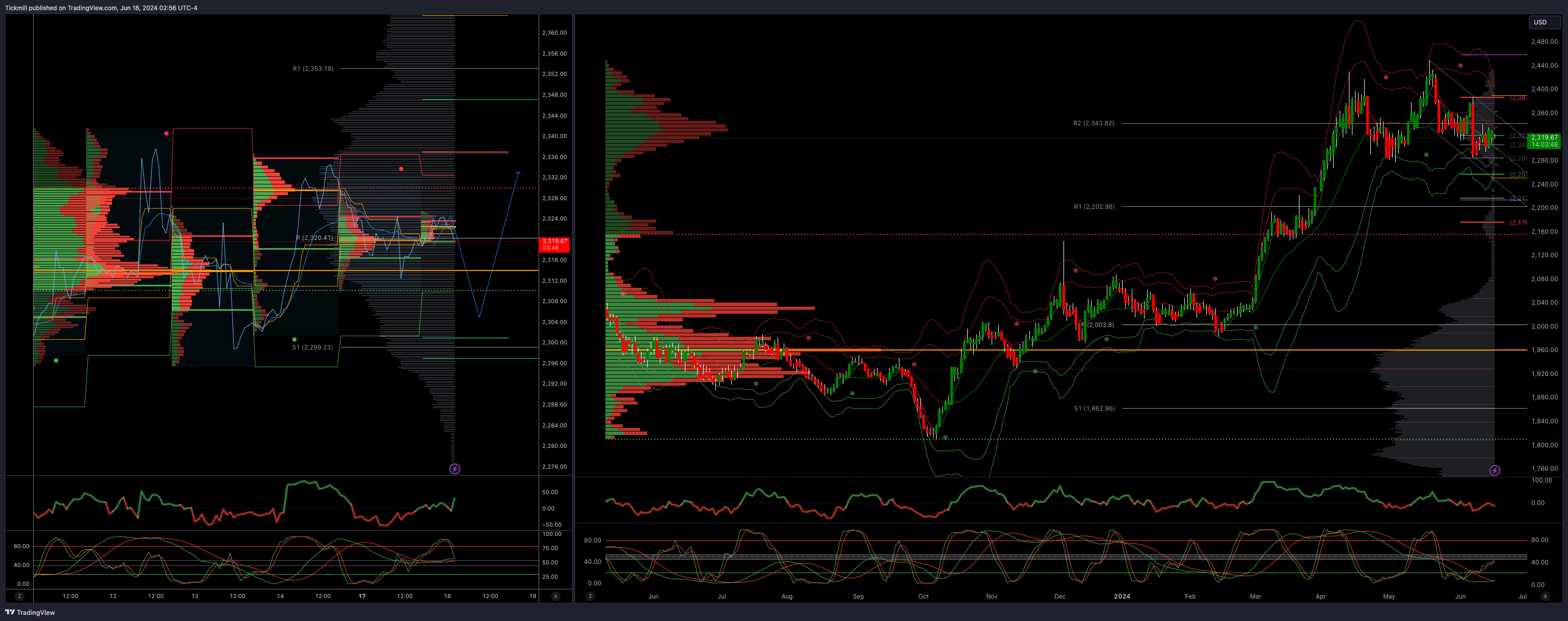

XAUUSD Bullish Above Bearish Below 2310

Daily VWAP bearish

Weekly VWAP bearish 2355

Above 2365 opens 2390

Primary support 2300

Primary objective is 2262

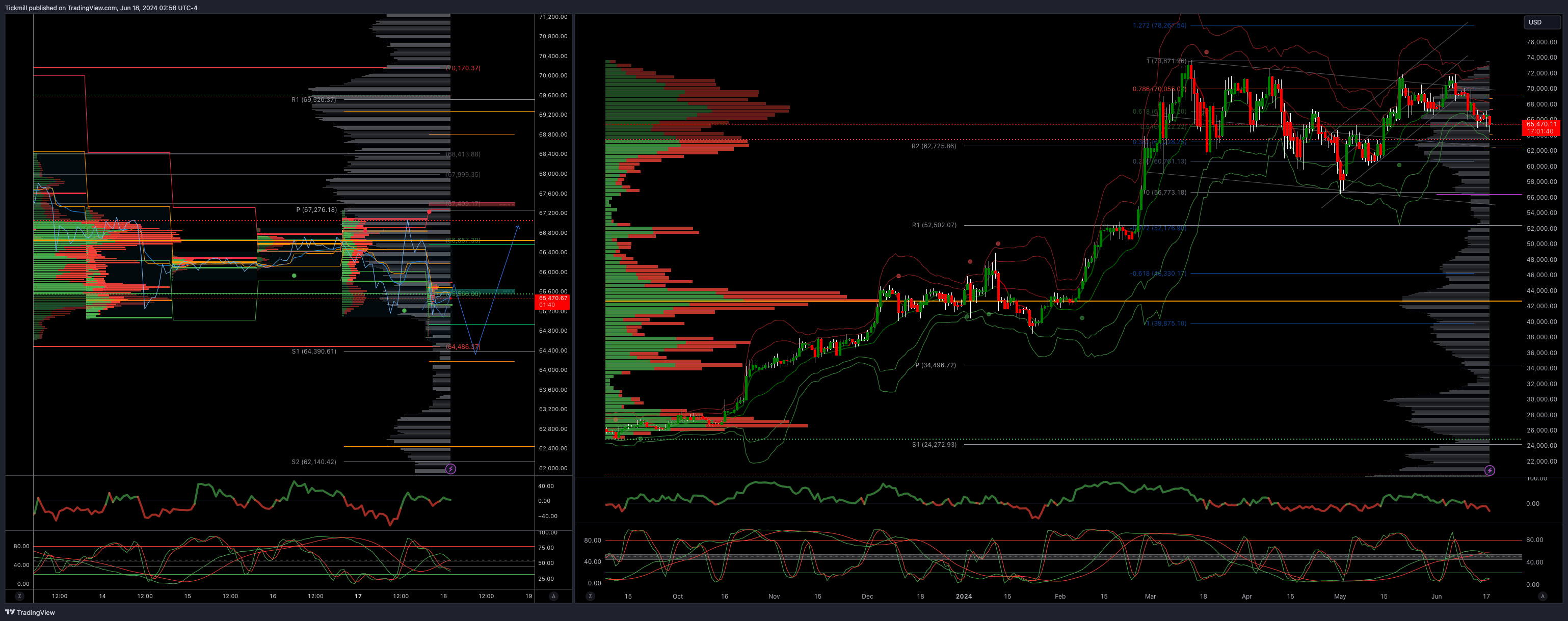

BTCUSD Bullish Above Bearish below 67250

Daily VWAP bearish

Weekly VWAP bearish 68015

Below 66300 opens 64500

Primary support is 64481

Primary objective is 78200

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!