Daily Market Outlook, July 15, 2024

Munnelly’s Macro Minute…

“Trump Assassination Attempt See’s Bitcoin Bid”

.After an attempted assassination, investors became more confident in Donald Trump's chances of winning the US presidential election, leading to a rise in the Dollar and a decline in Treasury futures. The Mexican peso dropped, the dollar strengthened against other major currencies, and Bitcoin reached its highest level in nearly two weeks. Futures indicated expectations of higher Treasury rates as cash trading began in Europe. These actions reflect bets on the possibility of the Republican-led administration implementing stricter fiscal policies and increased tariffs upon re-election, which is generally expected to boost the Dollar and lower Treasury values. Stocks in Asia experienced declines, particularly Chinese stocks in Hong Kong, following data indicating a slowdown in the world's second-largest economy. However, Indian shares rose and S&P 500 contracts suggested a higher open for the US market.

This week, the financial markets will be influenced by the European Central Bank rate decision, China's leadership meeting, a busy data schedule including Chinese GDP and monthly activity data, as well as U.S. politics and speeches by Federal Reserve officials. The ECB decision is expected to be the major event, with little surprise anticipated as markets predict a 95% chance of a steady 3.75% policy rate. The focus will be on inflation control and the timing of the next rate cut. Additionally, U.S. data such as retail sales, industrial production, housing starts, and speeches by Fed officials will provide insight into the economy. China's upcoming once-in-five-year meeting will be closely watched for potential policy changes to support the economic recovery. Meanwhile, the People's Bank of China is likely to maintain its one-year medium-term lending facility rate at 2.50% before the release of key economic data. The UK, Japan, and Australia will also contribute to the week's economic outlook with their respective data releases.

Overnight Newswire Updates of Note

BoE's Dhingra: Rates Should Come Down Now

US Secret Service Faces Intense Scrutiny After Trump Shot

US 10yr Treasury Notes Trades Below Its 200-Day Moving Average

China's Economy Slowed In The Last Quarter As Weak Consumer Demand Dragged On Growth

China’s Communist Party Meets To Set Direction For Troubled Economy

Dollar Buoyed By Safe-Haven Gains, Sliding Yen On Intervention Watch

Dollar Up, Bond Futures Down On Trump-Win Bets

Oil Wavers With Dollar Strength In Focus After Trump Shooting

XAU Keeps The Red Above $2,400, Amid Fed Rate Cut Bets

TSMC Q2 Profit Seen Jumping 30% On Surging AI Chip Demand

Bitcoin Climbs To More Than One-Week High After Attack On Trump

(Sourced from Bloomberg, Reuters and other reliable financial news outlets)

FX Options Expiries For 10am New York Cut

(1BLN+ represent larger expiries, more magnetic when trading within daily ATR)

EUR/USD: 1.0850 (1.2BLN), 1.0870-75 (1BLN), 1.0895-1.0900 (6.2BLN)

1.0910-20 (2BLN) , 1.0920-30 (1.8BLN), 1.0950 (1.1BLN)

USD/CHF: 0.8920-25 (350M). EUR/CHF: 0.9660 (600M) , 0.9700 (346M),

GBP/USD: 1.2970 (377M). EUR/GBP: 0.8400 (706M), 0.8445-60 (2.1BLN)

EUR/NOK: 11.6350 (1.1BLN). AUD/USD: 0.6750 (1BLN)

NZD/USD: 0.6095-0.6100 (301M), 0.6120 (201M)

USD/CAD: 1.3620-30 (654M), 1.3740-50 (840M)

USD/JPY: 157.75 (584M), 158.00 (1.2BLN)

AUD/JPY: 106.00 (250M), 106.25 (500M), 107.50 (600M)

CFTC Data As Of 9/7/24

Japanese yen net short position is -182,033 contracts

Euro net long position is 3,623 contracts

British pound net long position is 84,690 contracts

Swiss franc posts net short position of -46,088 contracts

Bitcoin net short position is -118 contracts

Equity fund speculators increase S&P 500 CME net short position by 47,949 contracts to 341,624

Equity fund managers raise S&P 500 CME net long position by 24,304 contracts to 977,432

Technical & Trade Views

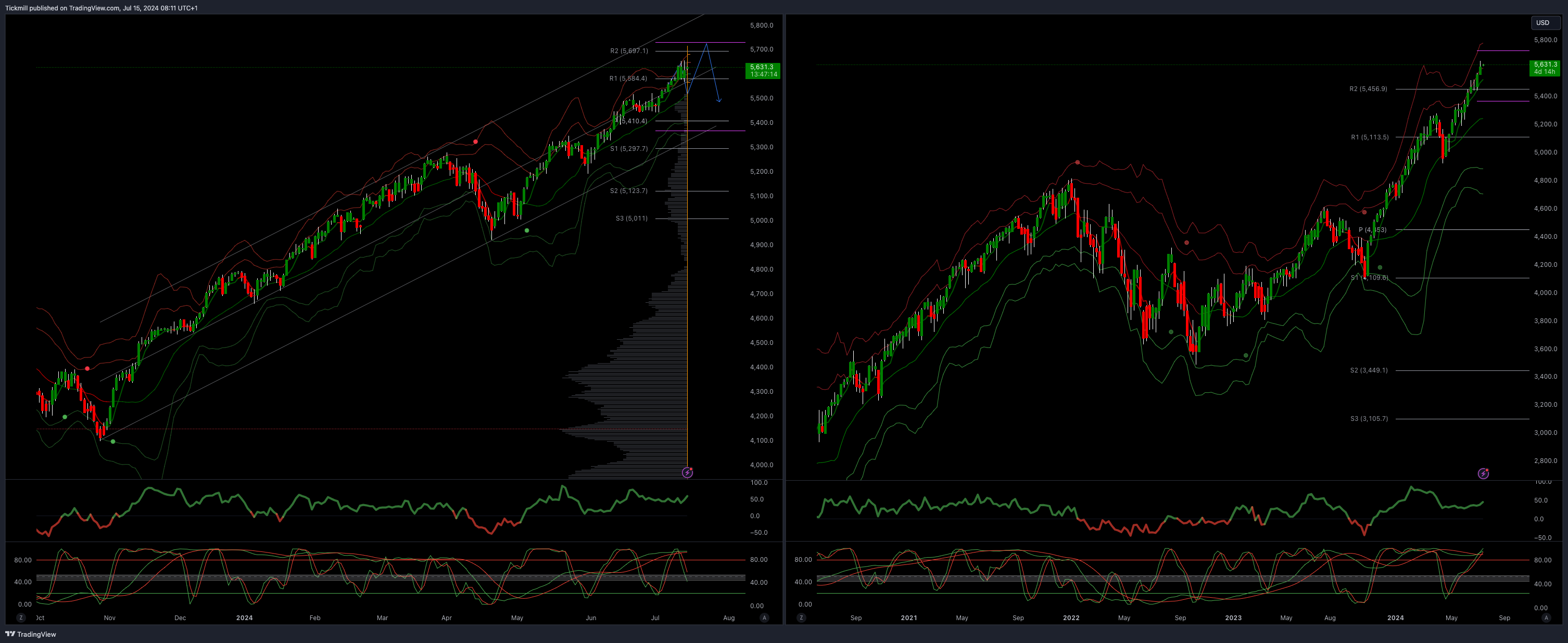

SP500 Bullish Above Bearish Below 5550

Daily VWAP bullish

Weekly VWAP bullish

Below 5475 opens 5450

Primary support 5400

Primary objective is 5700

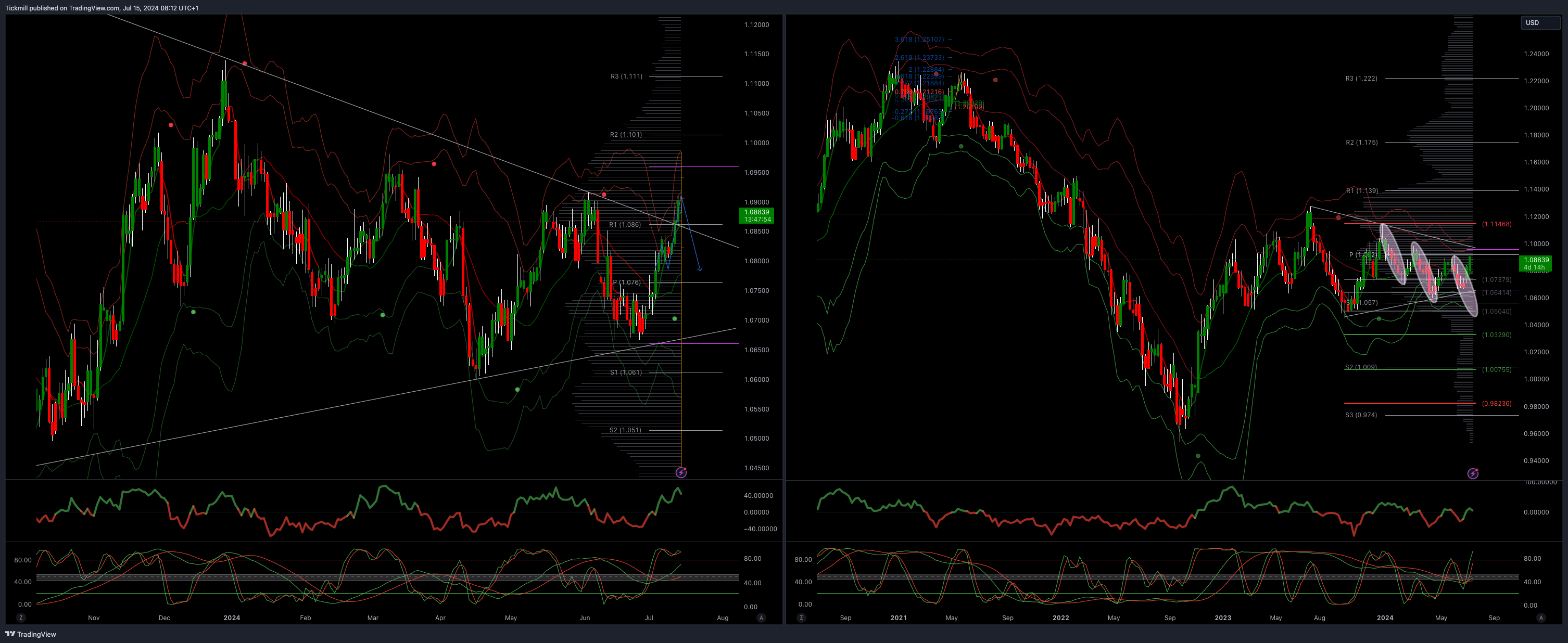

EURUSD Bullish Above Bearish Below 1.0750

Daily VWAP bullish

Weekly VWAP bearish

Above 1.880 opens 1.0940

Primary resistance 1.0981

Primary objective is 1.0650

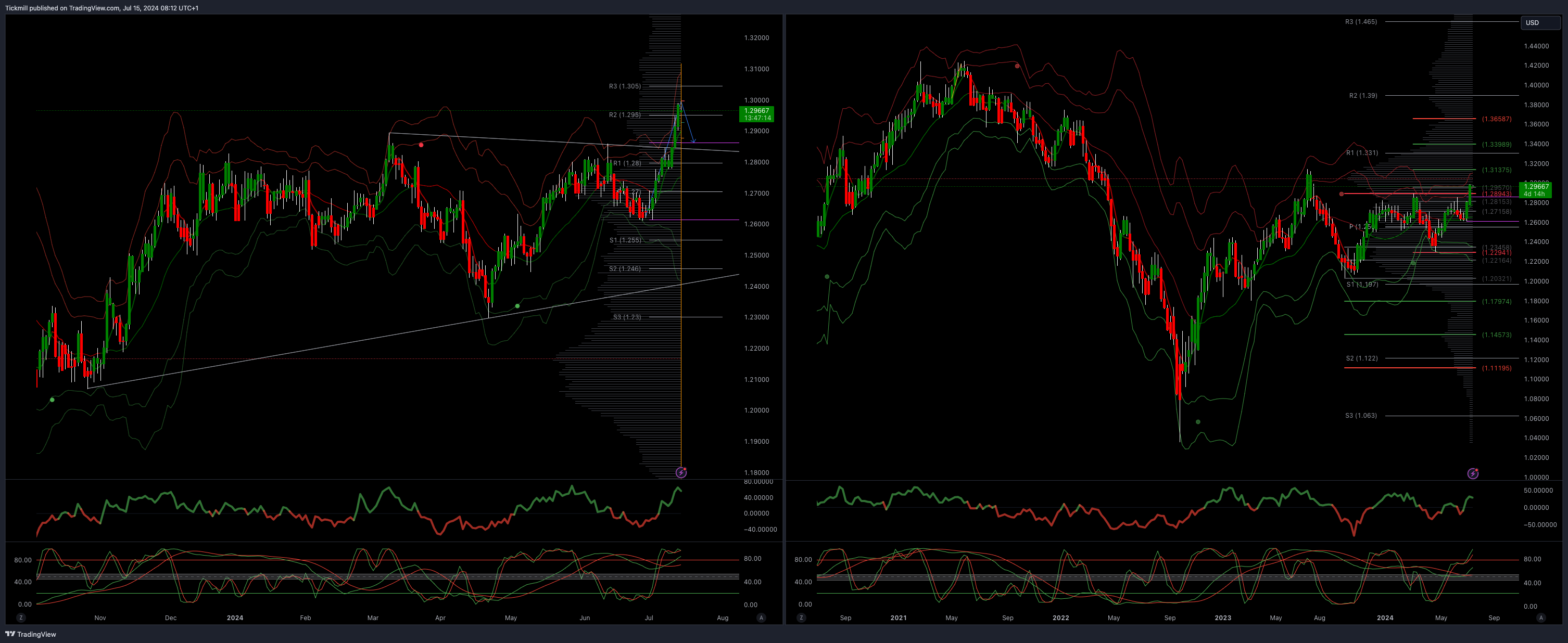

GBPUSD Bullish Above Bearish Below 1.28

Daily VWAP bullish

Weekly VWAP bullish

Above 1.29 opens 1.3130

Primary resistance is 1.2890

Primary objective 1.2570

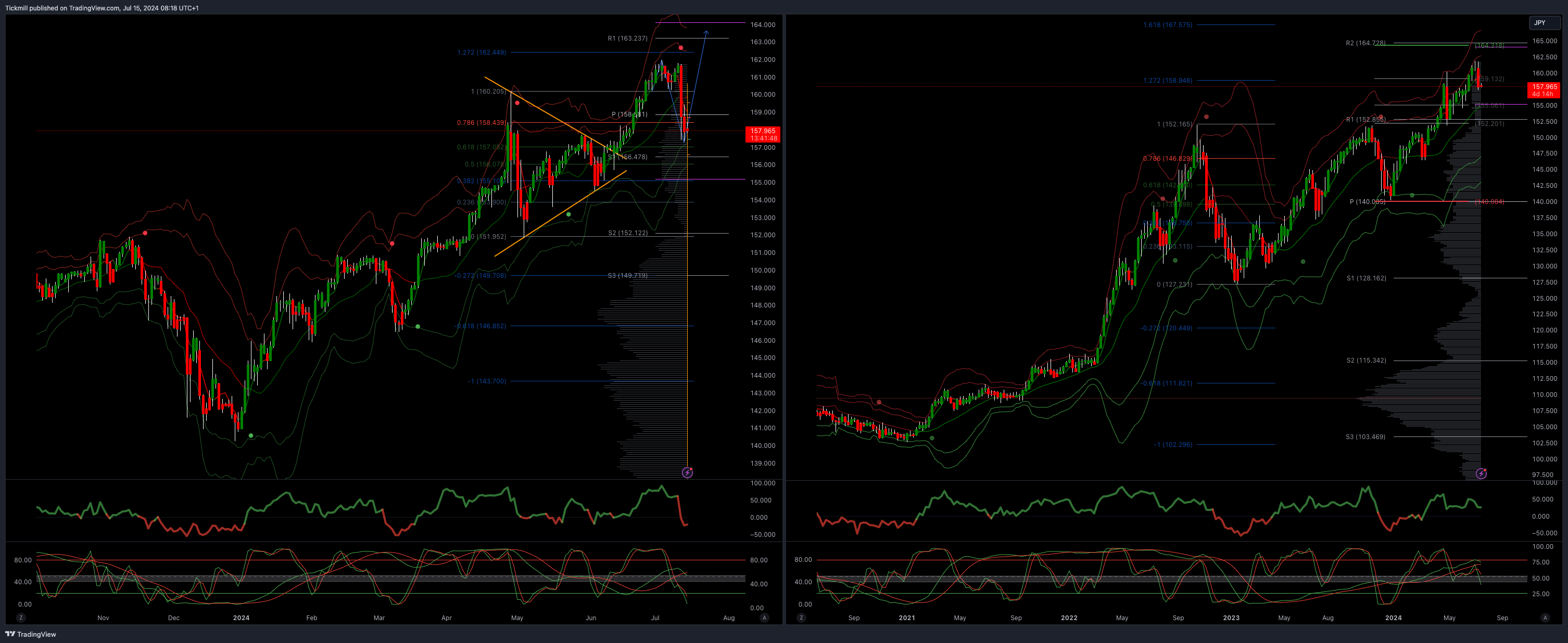

USDJPY Bullish Above Bearish Below 160

Daily VWAP bearish

Weekly VWAP bearish

Below 157.60 opens 157.10

Primary support 152

Primary objective is 164

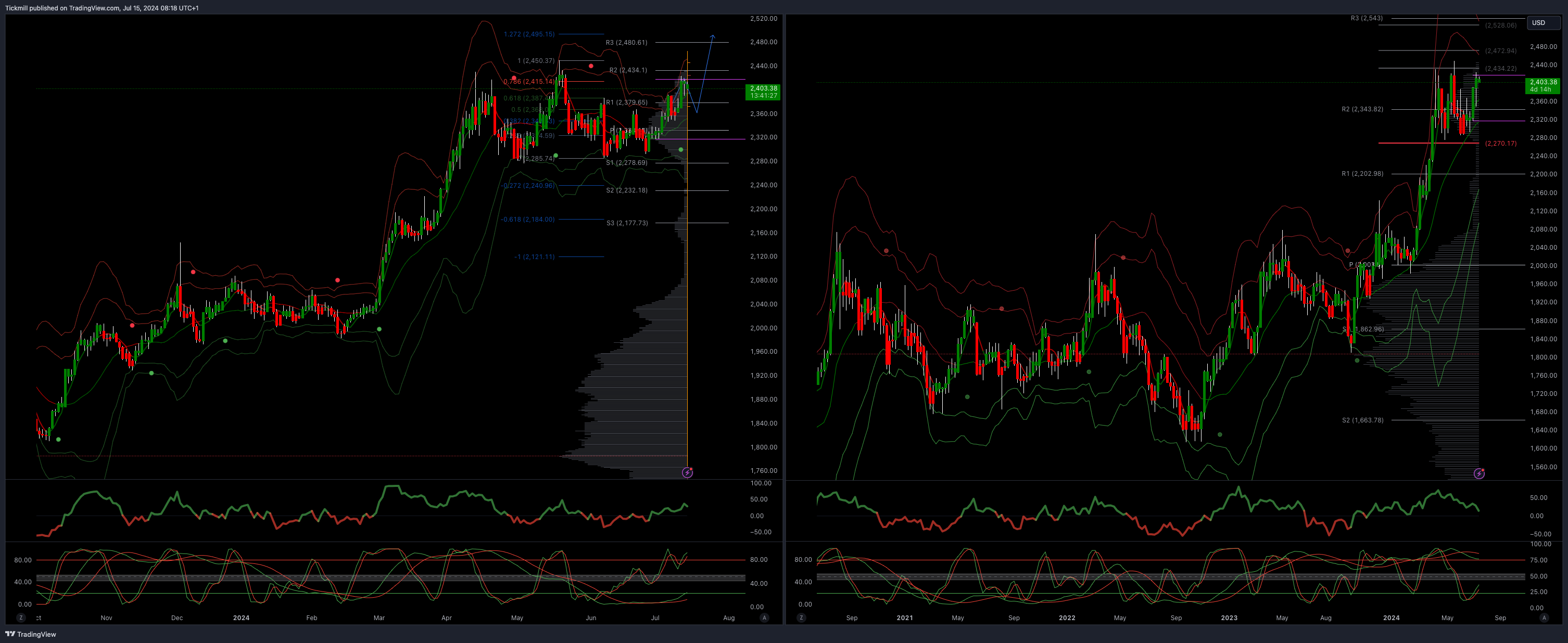

XAUUSD Bullish Above Bearish Below 2345

Daily VWAP bullish

Weekly VWAP bullish

Above 2415 opens 2495

Primary resistance 2387

Primary objective is 2262

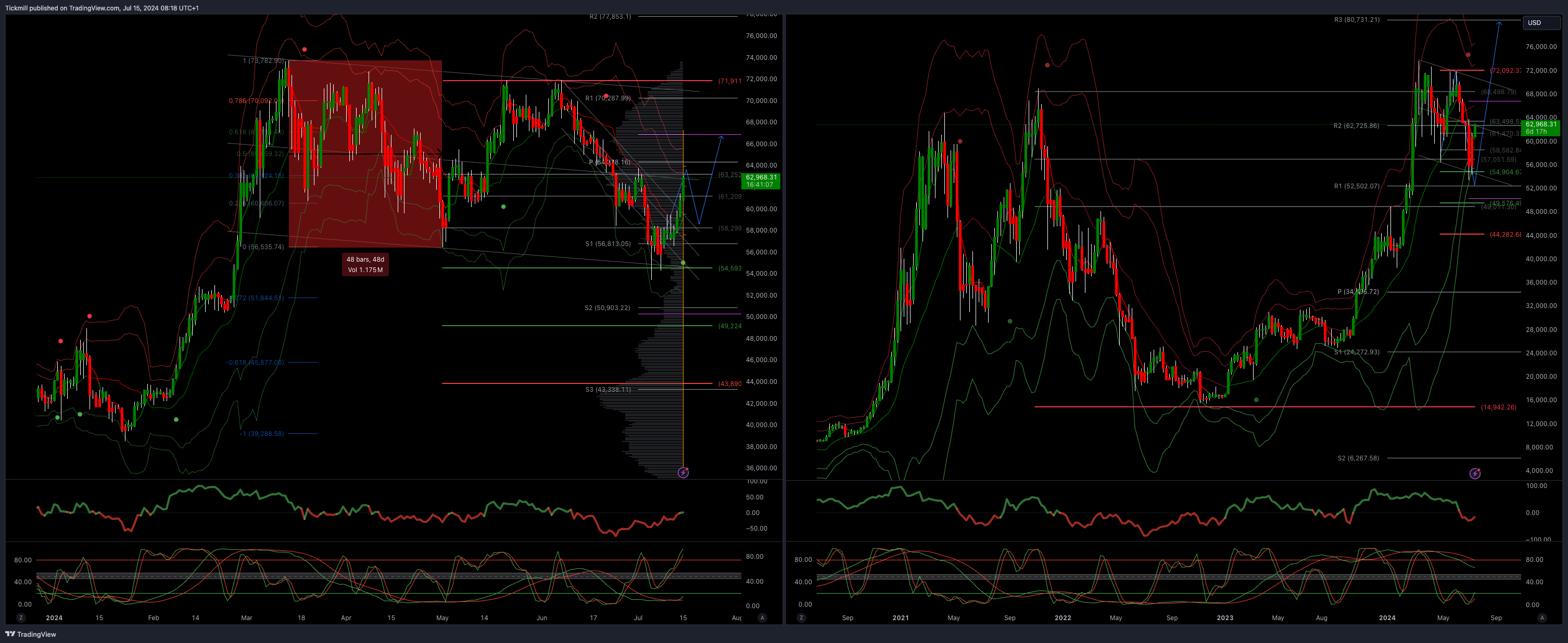

BTCUSD Bullish Above Bearish below 60000

Daily VWAP bullish

Weekly VWAP bearish

Above 67000 opens 70000

Primary support is 50000

Primary objective is 70000

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!