Crude Rally Capped For Now

Oil Slips From Early Highs

Oil prices have come under fresh selling pressure today following some initial strength at the start of the week as traders reacted to optimism over an expected US/China trade deal to be agreed this week. High levels talks over the weekend resulted in US and Chinese officials agreeing a framework for a deal which will include a fresh pause on tariffs beyond the Nov 10th deadline as well as provisions on US access to Chinese rare earth materials. The news has sparked a fresh risk-on mood across markets this week with equities and commodities rallying while gold and other safe-havens soften. Crude prices had initially been part of this risk on move; however, focus appears to have shifted back to over supply concerns with crude coming under fresh pressure accordingly.

Oversupply Fears Remain

A recent forecast from the IEA, projecting heavy oversupply in the coming year, remains a key headwind for crude bulls. The IEA signalled that rising production from American producers 9USA, Canada, Brazil, Guyana and Argentina, is expected to keep prices pressured through year end despite the better outlook on US/China trade now. A steady rise in OPEC+ output over the last six months has been a key theme in oil markets and with furtehr output hikes expected, oil could struggle to find higher ground. However, a concrete deal between the US and China this week, as well as a fresh Fed rate-cut should offer further near-term upside at the very least.

Technical Views

Crude

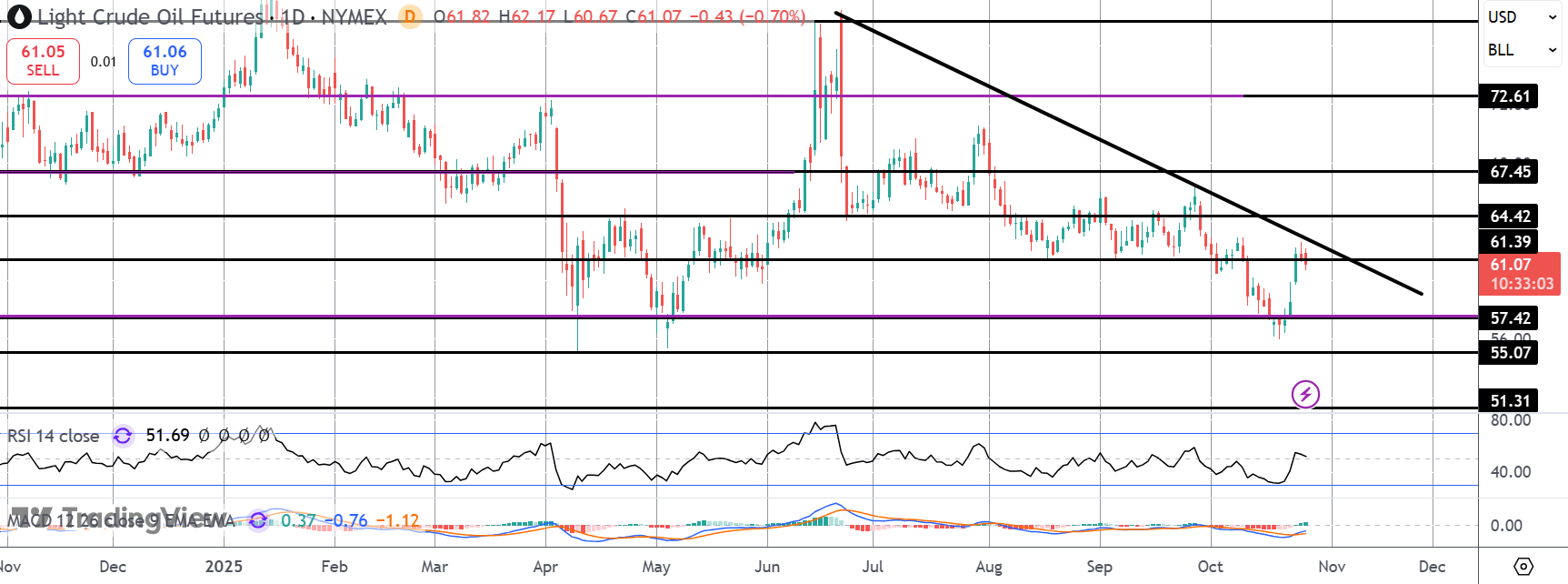

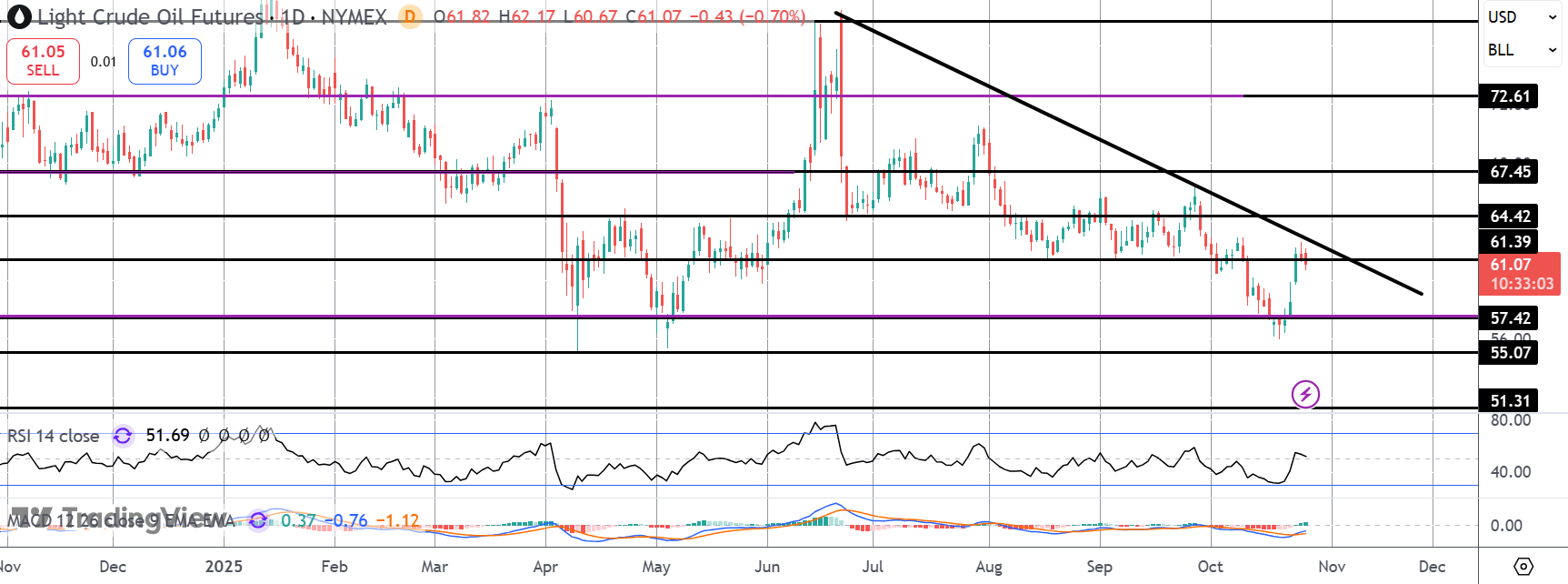

The rally in crude off the 57.42 level has stalled for now into a test of the 61.39 level and bearish trend line from summer highs. With momentum studies falling, risks of a fresh test of 57.42 are seen with the potential for a deeper move towards 55 and 51.31 longer-run. Bulls need to see price above the bear trend line to alleviate these downside risks.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.